A Nexamp challenge in New Jersey.

America group photo voltaic market put in a record-breaking 1.7 GWDC of capability in 2024, a 35% improve from 2023, in keeping with a new report launched by Wooden Mackenzie in collaboration with the Coalition for Neighborhood Photo voltaic Entry (CCSA). Nonetheless, with coverage uncertainty at each nationwide and state ranges, long-term development hangs within the stability.

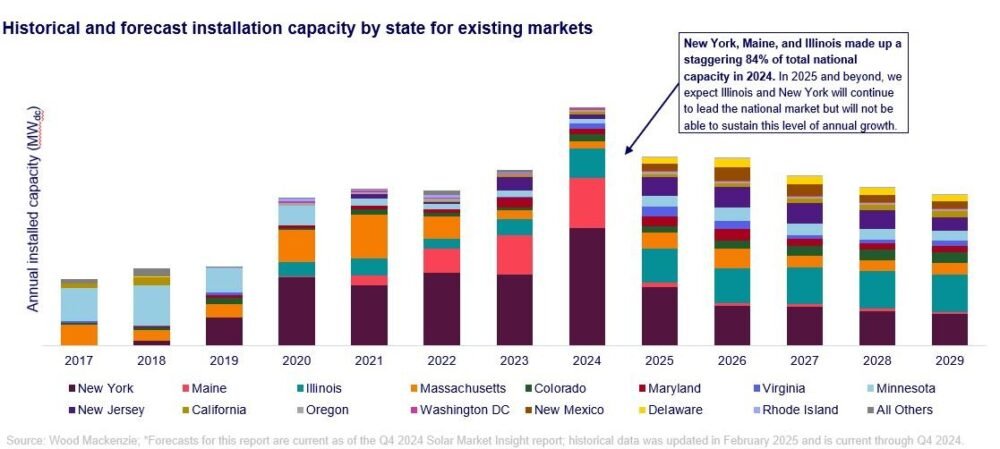

In accordance with the report, final 12 months’s development was led by New York, Maine and Illinois. All three states broke annual information and accounted for 83% of nationwide volumes. Cumulative group photo voltaic installations now complete 8.6 GWDC.

“We noticed spectacular exercise in 2024, leading to our strongest 12 months but for group photo voltaic development,” stated Caitlin Connelly, analysis analyst and lead writer of the report. “Nonetheless, regardless of spectacular 2024 set up volumes, the highest state markets are saturating shortly and won’t be able to maintain the identical ranges of development long-term. Moreover, rising markets have been sluggish to ramp up and program dimension caps restrict the potential for development in these states to make up for declines in bigger markets.”

Because of this, in Wooden Mackenzie’s base case, nationwide group photo voltaic development will contract 8% yearly on common by means of 2029, culminating in additional than 15 GWDC of cumulative group photo voltaic put in. Nonetheless, relying on how coverage adjustments and interconnection reform materialize, the expansion outlook may differ significantly.

“Though the brand new U.S. administration has fueled an excessive quantity of uncertainty within the U.S. photo voltaic sector, materials actions thus far have resulted in minimal adjustments to our base case outlook,” Connelly stated. “Nonetheless, in a low case representing an excessive draw back situation, our five-year outlook contracts 40% in comparison with the bottom case. Against this, enterprise as common on the federal degree and quickly bettering state coverage and interconnection circumstances lead to a excessive case outlook 37% greater than the bottom case.”

Potential new state markets

An space of increase may come from new state markets which have proposed laws for group photo voltaic packages. Within the final 12 months, laws in Pennsylvania, Ohio, Missouri, Iowa, Georgia, Washington and Wisconsin has progressed additional than ever earlier than, signaling robust bipartisan assist and the potential for brand new market enlargement. Neighborhood photo voltaic can be being integrated into main state power plans, equivalent to Pennsylvania’s Lightning Energy Plan, reinforcing its worth to lawmakers and regulators. If all involves cross, new group photo voltaic state markets have the potential to spice up base case outlook by a minimum of 16% by 2029.

“As opposition persists in establishing new legislatively enabled group photo voltaic packages, builders are evolving their enterprise fashions and exploring new avenues for community-scale improvement,” Connelly stated. “These assets are properly positioned to play a pivotal function in supporting grid resilience and elevated electrical energy demand given they are often deployed shortly, scaled shortly, and constructed with storage in proximity to the client load.”

LMI clients may broaden

Neighborhood photo voltaic capability instantly serving low-to-moderate revenue (LMI) subscribers is concentrated in New York and Massachusetts. The 2 states mixed comprise 49% of the 1 GWDC of LMI-serving group photo voltaic, highlighting the continued reliance on state and federal incentives to spice up LMI capability. In complete, LMI subscribers make up 14% of complete deployed group photo voltaic capability.

Stricter LMI subscriber necessities in rising state markets will lead to LMI capability making up practically 18% of complete group photo voltaic capability by 2026. Federal uncertainty concerning the LMI Communities adder and Photo voltaic for All funding may probably restrict the long-term development of LMI capability.

Developer and asset proprietor leaderboards stay extremely consolidated

The highest 5 group photo voltaic installers secured 19% of the market in 2024, down from 25% in 2023. The aggressive panorama for asset house owners is considerably extra unique, dominant and region-specific than that of group photo voltaic installers. The highest 10 group photo voltaic asset house owners secured 54% of capability put in in 2024 and 40% of cumulative capability. High asset house owners embody Nexamp, AES Clear Vitality and Nautilus Photo voltaic.

“Neighborhood photo voltaic’s record-breaking development in 2024 is a transparent signal that demand for inexpensive, distributed power is stronger than ever,” stated Jeff Cramer, CCSA President and CEO. “This report development comes at a time when buyer and grid demand for group photo voltaic has by no means been greater. Nonetheless, boundaries to assembly this demand — equivalent to interconnection delays and coverage crimson tape — are leaving dozens of gigawatts of recent native energy, tens of billions of {dollars} in funding and tens of millions of shoppers on the sidelines. With growing bipartisan momentum to deal with these challenges, the potential for continued report development stays robust.”

Information merchandise from Wooden Mackenzie

Trending Merchandise